Futurist > Companies creating the future > Defining DeFi: six companies driving the future of Decentralized Finance

Defining DeFi: six companies driving the future of Decentralized Finance

“If we assume that the WWW revolutionized information, and that the Web2 revolutionized interactions, the Web3 has the potential to revolutionize agreements and value exchange.”

Shermin Voshmgir, The Token Economy: How the Web3 reinvents the Internet

The premise behind Decentralized Finance (DeFi) is that the standard financial system can be rebuilt from scratch using blockchain-based technology. The idea is not to improve existing institutions, but to replace Kafkaesque bureaucracy and inefficient processes with smart contracts and tokenomics.

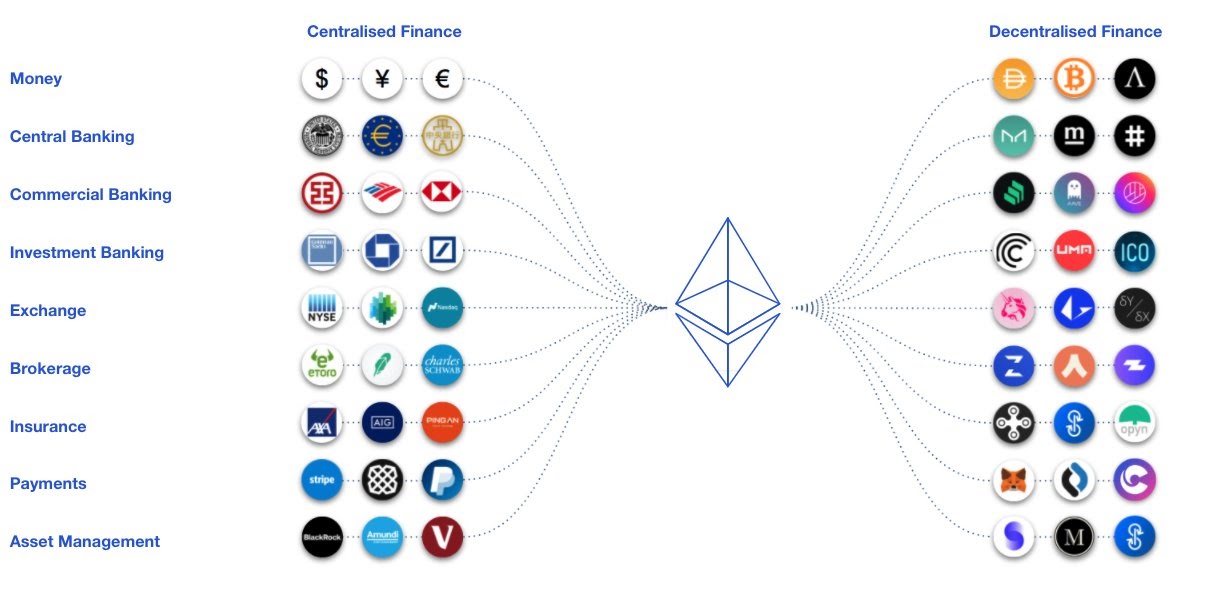

Source: Consensys

This helpful diagram shows how DeFi creates a ‘mirror’ of the Traditional Finance space. Later in this piece we will examine six specific examples of this transformation and their implications. But first, let’s examine the rationale for DeFi, and this alternative system that has sprung up in the past few years.

A brief history of crypto protocols

The famous whitepaper of Satoshi Nakamoto that launched Bitcoin is an essay on how to improve payment networks. In other words, the origin story of the whole blockchain revolution is a project to make the financial system work better at a fundamental level.

The Bitcoin network is limited to improving how payments are done. Subsequent variations on the original Bitcoin code have repurposed it to other tasks such as storage (Sia), or social networking (Steemit).

The evolutionary step-change, however, came with the creation of the Ethereum network, which was designed to be a multi-purpose protocol. Amongst other things, Ethereum users could perform any type of value transfer using smart contracts (programmable functions embedded in software) and tokens (exchangeable units of value).

The most famous example of a token is Bitcoin, but tokens in the Web3 realm have a much broader remit, and are closer to shareholder certificates, in that they can entitle the holder to governance rights as well as financial rewards.

Why replace traditional finance?

“Decentralization” is the core concept of DeFi. While more complex than Satoshi’s original vision, the guiding goal of today’s DeFi developers is the same as the one behind his original Bitcoin white paper.

Traditional financial institutions are centralized, in that all customers must transact via a bank or exchange, which will validate and facilitate those transactions and act as a custodian for assets. In a decentralized network, transactions are person-to-person (P2P), and assets are held in fragmented form across multiple computers or nodes rented out by private individuals.

The absence of an intermediary means: 1) lower cost 2) faster speeds. The system is also more reliable as it (in theory) eliminates the potential for human error, and less biased in that services are open to all.

The rise of the dApps

Smart contracts developed for the blockchain that facilitate specific processes are known as decentralized apps (dApps). DeFi dApps map on to the core functions of a bank: Payments, Saving, Borrowing, and Trading.

Escrow is an example of a traditional banking function that can be easily replicated and enhanced as a dApp in the DeFi universe.

When submitting advance payment for a service, the traditional approach requires a third party (such as eBay) to hold on to the funds and decide when to release them. This requires bureaucracy and cost, and also opens the door to human error. eBay also has the power to refuse transactions and block users from the platform.

In a ‘trustless’ escrow scenario, the transaction is intermediated entirely by a smart contract, which releases the funds if and only if the agreed conditions are met.

A sprawling complex of dApps is emerging organically to meet the financial needs of the DeFi community. While avoiding many of the drawbacks of traditional finance, it is at an early stage, and also carries its own set of risks.

Risks of DeFi

DeFi is a world without middlemen, or at least with fewer middlemen. Herein lies its attraction and its danger. As it is also a world without established regulation, it is a far more dangerous place than traditional finance for unsophisticated users. The comparison to the Wild West is a well-worn but well-earned cliche.

The largely unregulated status of DeFi makes it a playground for scam artists. Users have no official recourse if defrauded, and the immutability of blockchain-based transactions means that most losses are irreversible. Even without fraud, smart contracts are coded by humans, and human error can never be fully eliminated.

As the technology is typically built by experts for experts, user experience is typically worse than usual in mainstream finance. The preponderance of early-adopters means that the system is primarily designed for sophisticated actors familiar with its complexities, making it less hospitable for regular users.

Returning to the Wild West metaphor, however, this is indicative of early stage evolution rather than a fundamentally flawed or unworkable system. Time and pain will be necessary to see DeFi through to its fully mature state, but the frontier is slowly moving westwards.

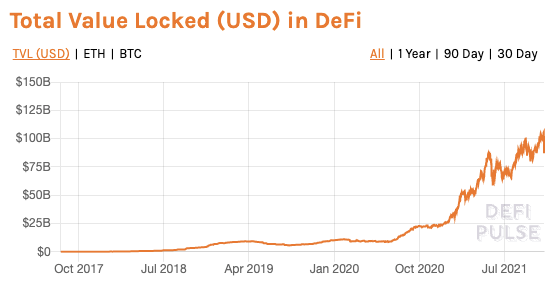

Rather than focussing on its deficiencies, it’s worth reflecting on what DeFi has achieved in its relatively short existence. A total of $100 billion in funds is currently contained in DeFi protocols, compared with $100 million in 2017.

Source: Defi Pulse

(Some) companies building the future

To get a sense of where this is headed, let’s take a look in more detail at some of the companies building the next phase of DeFi. This is a mix of better-known and less known companies, and is the tip of the iceberg in terms of interesting DeFi ventures. For a more comprehensive review on the workings of DeFi, we recommend the book Defi and the Future of Finance, which is also available as a paper.

Metamask

Tokens are to Web3 what blood cells are to the human body, and Metamask is a wallet for managing tokens. One of the leading wallets for users of the Ethereum network, it has grown from 500k to 10 million users in just a year.

One of the things that you will notice about the Metamask video is that it is not focused on ‘payments’. Instead, it indicates some of the scope of the potential of Web3 (autonomy, privacy, ownership). Crypto wallets are intended not merely as a functional means of storing crypto, but as a vehicle for exploring and operating in the new internet safely.

The word ‘wallet’ is somewhat misleading, as tokens are more than just money. The wallet itself is also not only a receptacle, but also a portal. The Metamask browser extension acts as a bridge between normal browsers and the Ethereum network. This means that you can explore the dApps of the Ethereum blockchain, like with Google Play, making it helpful for those new to the cryptoverse.

Compound

Lending and borrowing is the main function of a bank. Its role as an allocator of capital is its main contribution to the economy. For a viable, native financial system to exist on the blockchain, a means of borrowing and lending tokens had to be created.

Compound is one of the pioneers of the liquidity pool concept, which powered the DeFi boom of 2020. It operates similarly to a bank, in that those who deposit a crypto currency receive interest in the same coin.

It is different in that the interest is not ‘set’ by a central entity but determined by supply and demand algorithms. The mechanics of lending are also different. Lenders receive tokens equivalent in value to their deposit, which can be withdrawn and traded. They can also borrow other coins using their deposit as collateral. Both lenders and borrowers receive the native COMP token, which entitles them to participate in the governance of the Compound entity.

Compound is a DeFi pioneer worth following closely.

Rarible

By now everyone is familiar with non-fungible tokens (or at least the term NFT). As with the dotcom boom, the important question is not how long it will last but what parts of it will last. If nothing else, the NFT craze has focused the attention of investors and developers on the demand from creators for a means of monetizing their work in a decentralized fashion (with a higher ‘take rate’).

Rarible is a marketplace on the Ethereum blockchain that allows creators to issue and sell their creations in cryptographic form. The NFT model not only cuts out the intermediaries but also recreates the scarcity of the physical world, and harnesses the power of code to enforce intellectual property rights.

The Rarible marketplace not only sells art, but also memes and virtual land. And as with most dApps, it also issues its own governance token. This lets owners of the token not only influence how the platform is structured, but also moderate creators and curate artwork.

The aspect of token ownership is a key difference between Web2 and Web3: users are not sources of income for the company, they are the company. As blogger eshita summarized in a recent article: Web 1.0 = Read, Web 2.0 = Read + Write, Web 3.0 = Read + Write + Own.

Avalanche

While Ethereum remains the undisputed leader in the DeFi realm in terms of assets (referred to as Total Value Locked or TVL), rival protocols are constantly being created, with notable entrants such as Solana aiming to take the crown. The jury is still out as to whether the future Web3 will be all on one type of blockchain (such as Ethereum) or whether multiple chains will coexist serving different functions and communities.

Avalanche is aiming to create a smart contract platform superior to Ethereum with a particular focus on DeFi. It is focusing on one of the main weaknesses of Ethereum, which is the loss of speed that a network experiences when it becomes popular.

Their new approach results in a speed of 4500 transactions per second per submit and a completion time of 3 seconds. This compares with 7 transactions per second on the Bitcoin network and 1 hr to complete. In finance, where people expect and require speed and reliability above all else, this could potentially give it a lead in the battle for DeFi.

Nexus Mutual

As mentioned above, the DeFi world carries its own substantial risks. Aside from good old-fashioned confidence tricks, the most concerning risk concerns smart contracts, on which the entire premise of DeFi’s efficiency, reliability and superiority depends.

This can be mitigated, of course, with the age-old concept of insurance. Nexus Mutual offers coverage specific to smart contract risk, both in case of human error (i.e. bugs in the code) and malicious behavior (hacking, scams). It plans to expand coverage in the future to cover crypto wallets, and even standard hazards like earthquakes.

Not only this, but – as you would by now expect – it also aims to re-decentralize insurance itself. The white paper explains that insurance was originally a community-based model before morphing into an adversarial one, and blockchain-based technology can be used to restore the original ethos by using smart contracts to replace the established behemoths.

Serum

Lastly we come to trading. While there are platforms like Coinbase that are built for trading cryptocurrencies, these are not strictly speaking ‘DeFi’ as they are centralized organizations.

The decentralized exchange or DEX, on the other hand, replaces this centralized structure with code. Uniswap is the most celebrated DEX (see our article here on DAOs for a profile) in that it has caught up with Coinbase in terms of performance with far lower overheads.

Serum is a rival DEX built on the Solana blockchain, which like many Ethereum alternatives, has been designed to work faster. This enables Serum to run the exchange on an order-book basis (like Coinbase), rather than having to resort to the innovative but potentially less stable AMM (Automated Market Maker) concept on which Uniswap is based.

Closing words

Researching DeFi can be a difficult business, as the sector is in a continual state of primordial upheaval. Not even the main actors are clear what is going on, and terminology is still being established.

Rather than focusing on the details, which are best left to the developers, it can be more helpful to consider the long-term implications of finance becoming increasingly less dependent on traditional institutions.

Apart from greasing the wheels of the economy – making it easier for entrepreneurs to secure loans or send funds, for instance – the more radical changes may be to the nature of the economy itself.

The endgame of the decentralization transition is a more empowered individual, with a heightened ability to connect with similar groups and aggregate intellectual and financial firepower.

While established institutions have inertia on their side, this combination of break-neck innovation and the passion of ownership should not be underestimated. As Pacino’s Don Corleone says of the rebel fighters in Godfather 2, ‘They can win’.