Will venture capital keep flowing and when will new exits appear?

I visited several venture capital firms in Silicon Valley this week and also met the CEOs of a number of VC-funded companies. Not surprisingly, much of the talk was about the climate and outlook for venture capital, which is the spigot from which much of Silicon Valley drinks.

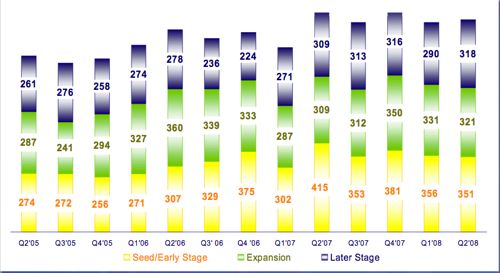

The MoneyTree Survey of venture capital, summarized in GigaOm , shows that total VC investments in the second quarter were basically flat over the last year or so, however with a slight continuing decline in early-stage investments. One of the key features is that late-stage investments are accumulating as exits become more difficult. IPOs had already dried up before the more recent stockmarket downturn, and now the tighter constraints on capital across the economy mean that trade exits are also falling off.

Source: MoneyTree via GigaOm

There is no question that venture capital is a tough business to be in at the moment. However the typical duration of investments today means that they have to be viewed over a full economic cycle. As one VC said, the days of flipping investments in nine months are long gone. In which case the key issue is what kinds of exits will be available once times are better than they are today.

While the IPO market could well open out somewhat from its current state of being slammed tightly shut, the scope is likely to be limited to large deals with specific characteristics, probably including profitability. This means that trade sales will probably continue as the major way of exiting investments. This, in turn, depends very much on the landscape of companies that are able and interested in buying technology start-ups. Certainly the tech majors of Google, Microsoft, and Yahoo! (or whatever that becomes) will be significant players, along with AOL and IAC.

The real opportunity will come when major media companies other than News Corp start realizing their best opportunity for repositioning comes from external innovation, and when adjacent industries such as telecoms, network equipment, and consumer electronics become active buyers of start-ups. When not just Deutsche Telekom and Samsung enter the market, but also Huawei and its ilk, ample exits will be available. As described in our Future of Media Strategy Tools framework, industry adjacencies will start to dominate the evolution of the industry. However by then it will be too late to invest for that cycle. So the VCs have to grit their teeth, and as they are, continue to invest into a downmarket.